Introduction: Why Solar Generators Matter Today

Solar generator systems — combining modules photovoltaïques, battery storage, and inverter control — are no longer niche. From homeowners preparing for outages to businesses seeking energy resilience and sustainability goals, they play a growing role in energy security and green strategy. As more firms search for “solar generator ROI,” “solar battery backup cost,” and “renewable energy financing,” understanding whether to lease or buy has become a critical decision. This article helps you assess leasing versus ownership through rigorous financial analysis.

Leasing Solar Generators: How It Works & When It Makes Sense

What is Leasing?

Under a lease agreement, the provider (e.g. Sunpal Energy or its partner) retains ownership of the solar generator hardware. The customer pays a fixed rental or service-fee — typically monthly — in exchange for power generation rights and backup function, often over a fixed-term contract (e.g. 5–20 years).

Key Features of Leasing

- Low or zero upfront capital required

- Monthly payments cover usage, maintenance, and possibly upgrades

- Provider may be responsible for repairs, monitoring, and performance guarantees

- Lease may include escalation clauses (annual increase)

- At the end of lease, options may include renewal, upgrade, or termination

When Leasing Makes Sense

- You want to avoid large initial investment

- You prefer predictable monthly costs

- Your project is short-term or you expect to upgrade technology soon

- Your tax liability is limited (so you can't fully utilize incentives)

Buying Solar Generators: Costs, Incentives & Long-Term Value

What Does Buying Mean?

Buying involves owning the system outright — either via cash purchase or financed through a loan. You're responsible for installation, maintenance, and reap full benefits of power generation and energy cost reduction.

Cost Components & Incentives

- Upfront Investment: purchase price of panels, inverters, battery storage, installation labor, and permits

- Financing Options: cash, solar loan, or equipment financing

- Incentives & Credits: tax credits, government rebates, clean energy subsidies (where applicable)

- Depreciation / Asset Value: system may become an appreciating asset for your facility or property

Long-Term Advantages

- Full access to energy savings over the lifetime (often 10–30 years)

- Eligible for incentives (e.g. tax credits) that reduce net cost

- Potential increase in asset or property value

- Ownership voice in tech upgrades or system modifications

Financial Comparison: Leasing vs Buying

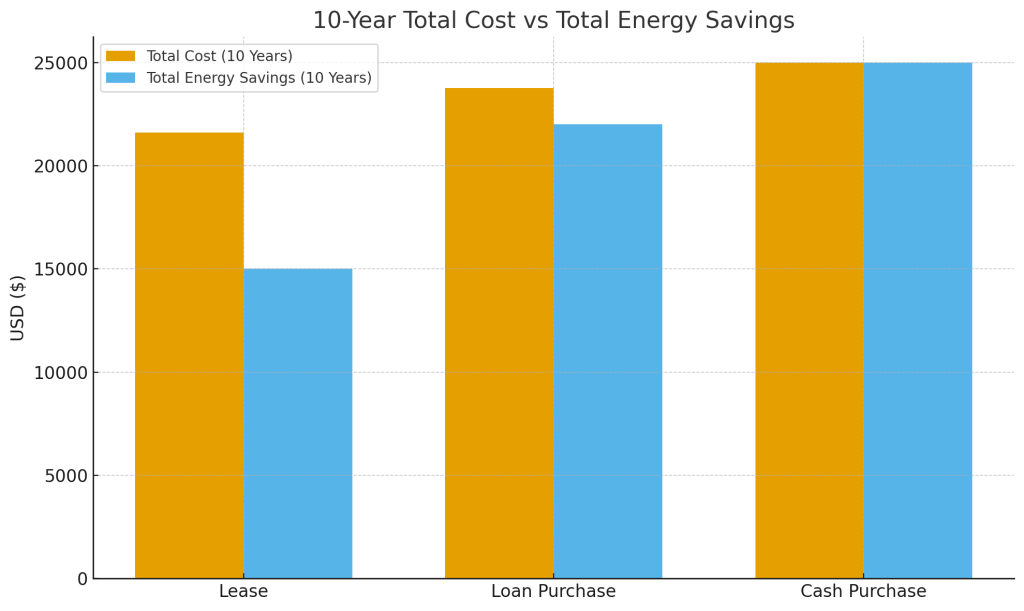

Below is a hypothetical scenario comparing leasing and owning a 5 kW solar generator + système de stockage par batterie over 10 years.

| Metric | Leasing Option | Buying Option (Loan) | Buying Option (Cash) |

| Coût initial | $0 up front | Loan down-payment (e.g. 10 %) | Full cost (e.g. $25,000) |

| Monthly Payment | $180 / mo (escalating at 2 %) | $220 / mo loan repayment | $0 payment after purchase |

| Maintenance / Service | Covered by lease provider | Owner responsibility + warranty | Same as loan option |

| Incentives / Credits | Claimed by lessor (you don't benefit directly) | You claim eligible credits | Full benefit of incentives |

| Energy Savings Over 10 Years | ~$15,000 (net after payments) | ~$22,000 (after loan paid off) | ~$25,000 (net savings) |

| Net Present Value (NPV) Comparison | Lower than ownership | Modéré | Highest |

| Residual Value / Ownership | None (you don't own) | You own after loan term | Owned from the start |

Chart 1:

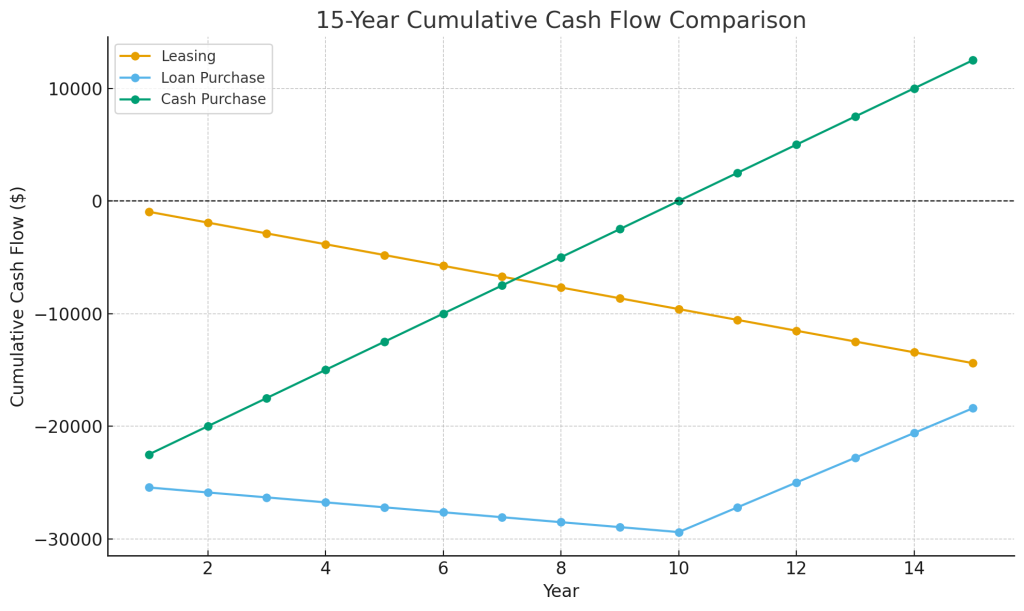

Graphique 2:

This simplified model shows that while leasing offers no upfront cost, it tends to deliver lower lifetime savings compared to buying — especially when incentives, asset value, and ownership are factored in.

Beyond Money: Operational & Strategic Factors

Financial metrics are vital — but so are non-financial factors:

Flexibility & Upgradability

Leasing may allow you to upgrade battery or generator technology mid-contract. Ownership may lock you into hardware, but you retain full control.

Maintenance & Reliability

With leasing, the provider usually handles monitoring, repairs, and performance guarantees. Ownership means you may hire third-party maintenance or rely on warranties.

Technology Obsolescence Risk

Solar generator & battery tech evolves fast. Leasing could mitigate the risk of being stuck with outdated capacity or battery chemistry.

Energy Independence & Brand / ESG Value

Ownership often aligns better with long-term sustainability strategy, ESG reporting, and corporate energy resilience goals.

Resale / Deployment Mobility

If you move facilities or scale up, owning your equipment gives you asset mobility; leases may require renegotiation or termination fees.

Long-Term Financial Impact: ROI, LCOE & Payback

Retour sur investissement (ROI)

When you buy a solar generator, ROI depends on factors like electricity cost avoided, maintenance cost, system degradation rate, and financing interest. For example, if electricity rises at 3 % per year, owning the system yields compounding savings beyond break-even point.

Coût de l'énergie nivelé (LCOE)

Ownership allows you to compute LCOE — total life-cycle cost per kWh produced — which typically becomes favorable after the payback period (often 7–12 years depending on battery size and usage). Leasing often has higher LCOE because monthly lease fees include provider margin and service risk.

Période de récupération

- Buying via loan: payback period = loan-term + time to recoup system cost via bill savings

- Buying cash: shorter payback, full savings immediately after payback

- Leasing: there is no “ownership break-even” point — you're paying for service, not building equity

Strategic Value

Ownership can enhance property or facility valuation. It also contributes to ESG performance metrics, which may help you access green financing or favorable insurer ratings.

Which Option Suits Your Strategy?

Here's a quick decision checklist:

| Choisir Leasing if… | Choisir Buying if… |

| You lack capital for upfront investment | You can finance or pay cash for long-term savings |

| You prefer fixed monthly budgeting and want provider-managed maintenance | You want full ownership, claim incentives, and maximize ROI |

| You may upgrade system every 5–10 years | You plan to stay in your facility for 10+ years or expand capacity |

| You prefer minimal risk of hardware maintenance | You want to capture ESG value, asset value, and full energy independence |

| User Segment | Best Fit |

| Small business with variable cash flow | Leasing may reduce financial burden |

| Industrial facility with high reliability demands | Buying delivers better long-term ROI |

| Off-grid / remote applications | Ownership may enhance self-sufficiency and asset equity |

Sunpal Energy's Expert Insight

Chez Sunpal Energy, our solar generator solutions (on-grid, off-grid backup, and hybrid battery-storage systems) are designed for performance, durability, and scalability. We support clients by running detailed financial models that compare both leasing and buying scenarios side by side — customized to your electricity usage schedule, battery dispatch needs, and capacity requirements.

We help you simulate ROI, payback, and long-term cost of energy (LCOE) under both ownership models, so you can choose the best path for your energy strategy.

Conclusion & Call to Action

Leasing offers convenience and zero upfront cost — but often delivers less total savings. Buying requires more capital today, but unlocks higher long-term return, asset ownership, and strategic value.If you'd like to explore what's more cost-efficient and future-proof for your facility, let Sunpal Energy run a tailored leasing vs buying analysis for your project. Contact us to get your personalized solar generator financial model, and choose the path that fits your energy goals.